Direct Offshore Workers MUST Receive Australian Minimum Wages and Conditions

- Gabriel Wee

- Nov 21, 2024

- 3 min read

OFFSHORING FAIR WORK CASE:

JOANNA PASCUA V DOESSEL GROUP PTY LTD [2024] FWC 2669

Recently, the Fair Work Commission has determined that a Philippines-based “independent contractor” was, in fact, an employee who was unfairly dismissed by her Australian employer. In the case of Joanna Pascua v Doessel Group Pty Ltd [2024] FWC 2669, Ms. Joanna Pascua claimed unfair dismissal from Doessel Group Pty Ltd under Australia’s Fair Work Act 2009.

Issue:

Ms. Joanna Pascua claimed she was unfairly dismissed by Doessel Group Pty Ltd and sought a remedy under the Fair Work Act 2009.

The central question was whether she was an employee (entitled to unfair dismissal protection) or an independent contractor (ineligible for such protection under the Act).

Background:

Ms. Pascua worked remotely from the Philippines as a paralegal for Doessel Group, performing tasks for MyCRA Lawyers in Australia.

The terms of the contract described her as an independent contractor, but her work included fixed hourly payments of $18 AUD, daily task assignments, supervision by company personnel, and specific performance targets.

She was provided with a company email and phone system that made her appear to be in Australia, integrating her closely with Doessel Group’s business operations.

National System Employee:

The Fair Work Commission (FWC) examined whether Ms. Pascua qualified as a "national

system employee" under Australian law.

The FWC ruled that if she was indeed an employee, Doessel Group, as a constitutional

corporation, would be her employer, making her eligible for protections under the Fair Work Act as a national system employee.

Minimum Wages:

The FWC noted that the hourly rate stipulated in Ms. Pascua’s contract ($18 AUD) was

significantly lower than the minimum wage set out in the relevant Legal Services Award. For a full-time Level 2 employee, the award rate at the time the contract was entered into on 21st July 2022 was $24.76 per hour, with a casual rate of $30.95 per hour, given the lack of additional benefits like annual, sick leave and other entitlements in her contract. The low rate indicated she was likely not engaged as an independent contractor with specialist skills, as contractors typically earn higher rates than employees performing similar work.

An employment relationship would entitle her to minimum wage protections under this

award, which would require significantly higher pay for her role as a paralegal.

Judgment:

The FWC ruled that despite the "independent contractor" label in the contract, the true nature of Ms. Pascua’s working relationship was that of an employee due to her tasks, control by the company, and payment structure.

Doessel Group’s objection was dismissed, allowing Ms. Pascua’s unfair dismissal claim to proceed to a hearing on its merits.

LEGAL SERVICES AWARD

As of 1st July 2024, the hourly rate under the Legal Services Award for a Level 2 staff in Australia is $27.17 for full-time or part-time staff. For casual staff at the same level, the hourly rate is $33.96 due to casual loading. Although these rates apply to legal services, they may also be similar for real estate administration, bookkeeping, accountancy, and other fields. (Please check with Graphite Business Advisers for the applicable rates.)

These rates reflect recent adjustments following a 3.75% increase to align with annual Fair Work Commission updates:

CHANGES TO WORKPLACE LAWS

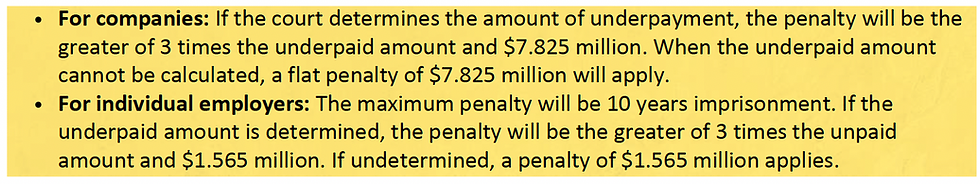

Starting on 1 January 2025, intentional underpayment of wages or wage theft will be classified as a criminal offence. Businesses have a legal obligation to pay employees fairly, including for any conduct that occurred prior to the implementation of this law. Failure to fulfill this obligation can lead to severe penalties:

SOLUTION AND OPTIONS

The employer can continue hire the current staff and paying the minimum wage of $32.56 for an hour, ensuring compliance with the relevant Australian wage laws for staff working remotely in other countries.

Set up a company in overseas to support the business operation, hence avoiding Australia minimum wage requirement.

Opt for operators like My Team Stars, which are 100% covered and IT-controlled, ensuring smooth and secure remote operations - MYTS has operations in both Malaysia and Australia, hence we can pay below Australian min wage and our staff’s wage starts at $2,000 per month.

Comments